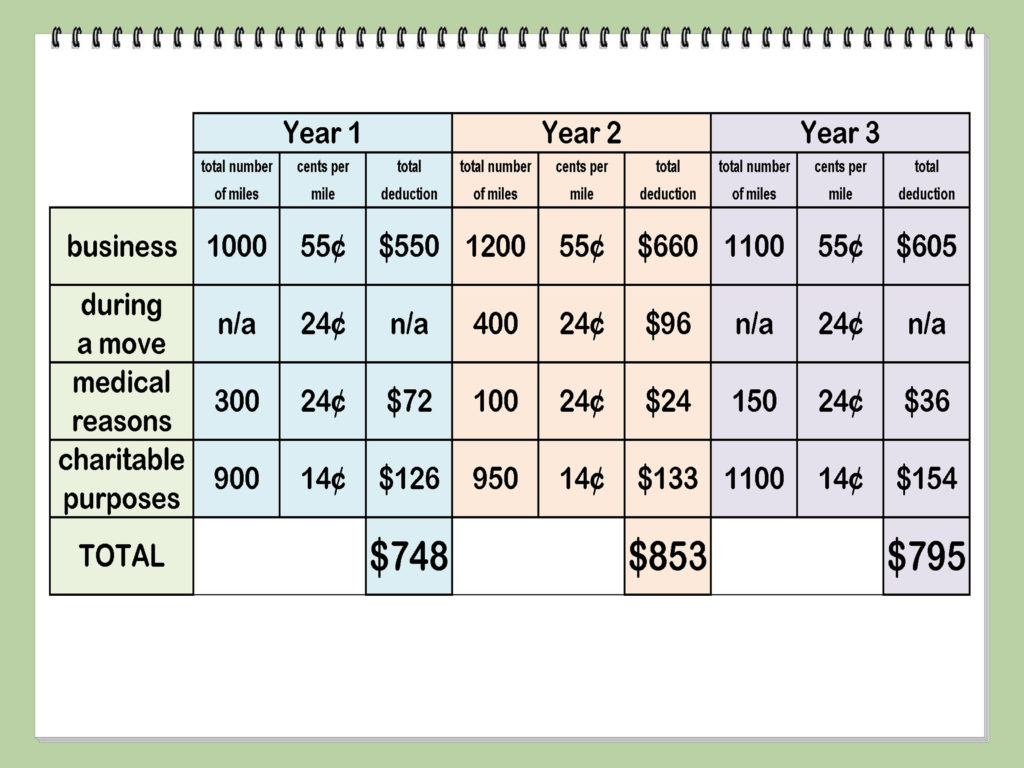

Irs Mileage Rate 2025 Calculator. Calculate reimbursement with the mileage rate calculator. 65.5 cents per mile for business purposes.

Our free online irs mileage calculator makes calculating mileage for reimbursement easy. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

Current Irs Mileage Rate 2025 Announcement Fayre Jenilee, Having employees use their own vehicle for work can be expensive.

2025 Mileage Rate Irs Dehlia Layney, The a free irs mileage calculator is designed to help you understand your mileage deduction for 2025 or 2025.

Irs Mileage Rate 2025 Calculator Chere Myrtice, Our calculator uses the latest irs mileage rates to estimate your reimbursement based on the miles you’ve driven and the purpose of the drive (business, medical/moving, or.

Mileage Rate 2025 Irs Gabbi Kailey, Our 2025 mileage deduction calculator uses standard irs mileage rates to calculate your mileage deduction for taxes or reimbursement.

Irs Mileage Calculator 2025 Allis Courtnay, Use the free irs mileage rate calculator below to estimate the reimbursement or tax deduction you are.

2025 Mileage Reimbursement Calculator Pat Layney, Calculate reimbursement with the mileage rate calculator.

Arizona Mileage Reimbursement Rate 2025 Renee Charline, The irs mileage rates for 2025 vary based on the purpose of travel.

IRS Mileage Reimbursement Rate 2025 All You Need to Know about the 1., Our calculator uses the latest irs mileage rates to estimate your reimbursement based on the miles you’ve driven and the purpose of the drive (business, medical/moving, or.